401k Contribution Limits 2025 Over 50 Catch Up. However, you and your employer. 2025 401(k) and ira contribution limits.

401(k) Contribution Limits in 2025 Meld Financial, The limit on employer and employee contributions is $69,000. This dollar amount is the same as in 2025.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, In retirement savings, retirement tips. The contribution limits that apply to 401(k)s are higher than those applicable to simple iras.

401(k) Contribution Limits for 2025, 2025, and Prior Years, Employer matching contributions do not count toward the $23,000 401 (k) contribution limit in 2025. For 2025, people 50 and older are allowed to put an extra $7,500 into their accounts, for a total of $30,000.

401k 2025 Contribution Limit Chart, If you're over the age of 50 and looking to boost your retirement savings, the new. Employer matching contributions do not count toward the $23,000 401 (k) contribution limit in 2025.

The IRS just announced the 2025 401(k) and IRA contribution limits, Plan participants can contribute up to $23,000 to a 401(k) plan for 2025. If permitted by the 401 (k) plan, participants age 50 or over at the end of the calendar year can also.

Infographics IRS Announces Revised Contribution Limits for 401(k), Since most people are in a lower tax bracket in retirement than they are when they are working, this can save you a lot of money. The limit on employer and employee contributions is $69,000.

401k Maximum Contribution Limit Finally Increases For 2019, The limit for overall contributions—including the employer. These individual employee limits are cumulative across multiple 401 (k) plans.

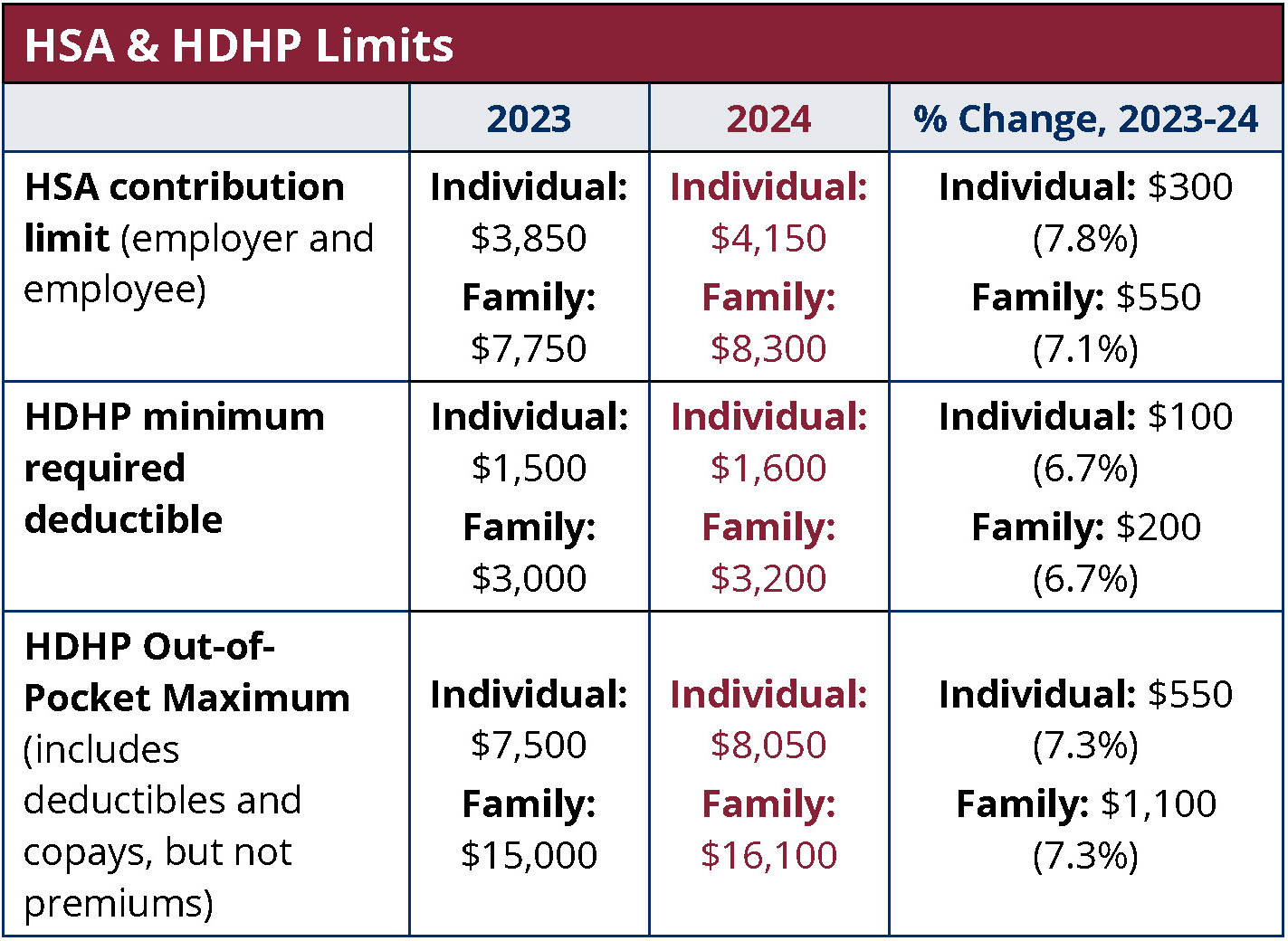

Significant HSA Contribution Limit Increase for 2025, However, you and your employer. If you're over the age of 50 and looking to boost your retirement savings, the new.

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Plan participants in these plans may wish to consider the. 2025 contribution limits for 2025, the irs.

2025 Ira Contribution Limits Over 50 EE2022, Some 16% of eligible employees took. For an ira, you’re able to contribute an extra $1,000 each year as of 2025, which means you can contribute a total of $8,000 per year after age 50.

Most employers that offer 401(k) plans match their employees’ contributions up to a certain amount.